This Week’s Earnings Calendar: Navigating a Sea of Information and Unpacking the Market’s Expectations

Associated Articles: This Week’s Earnings Calendar: Navigating a Sea of Information and Unpacking the Market’s Expectations

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to This Week’s Earnings Calendar: Navigating a Sea of Information and Unpacking the Market’s Expectations. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

This Week’s Earnings Calendar: Navigating a Sea of Information and Unpacking the Market’s Expectations

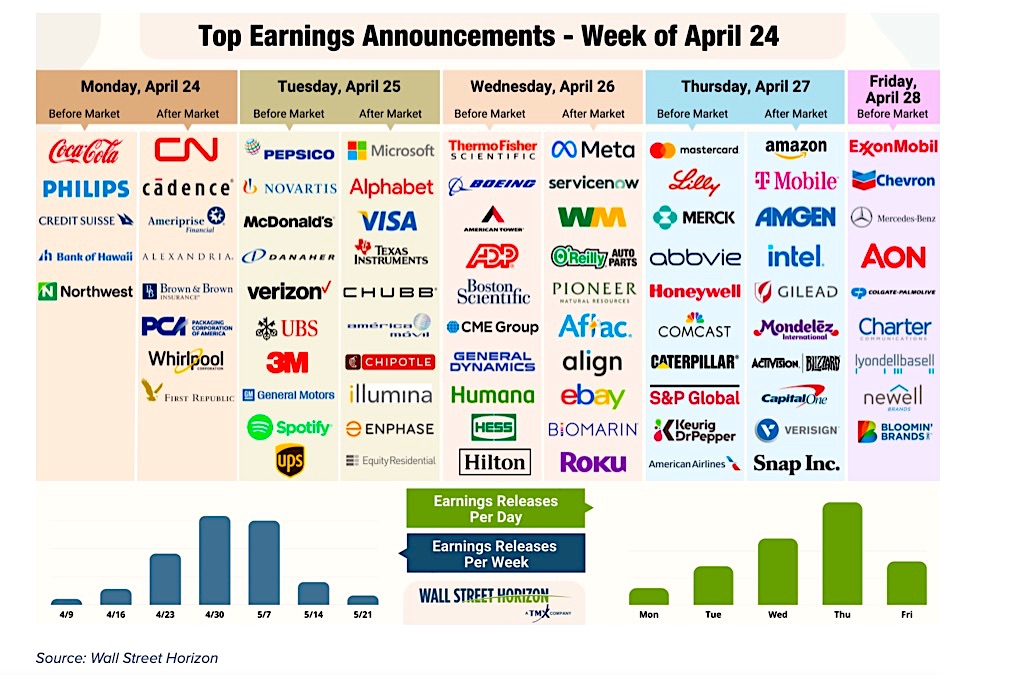

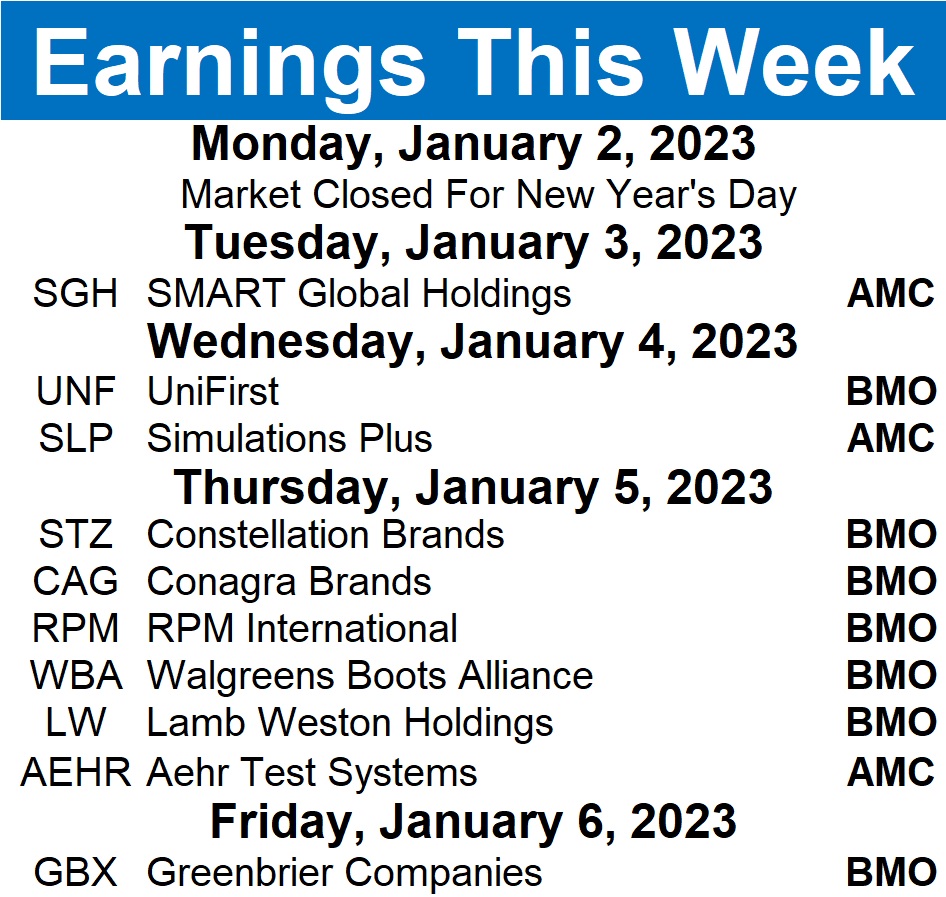

This week’s earnings calendar is a bustling hub of exercise, with a various vary of corporations throughout numerous sectors reporting their monetary efficiency for the [Specify Reporting Period, e.g., second quarter of 2024]. From tech giants battling slowing progress to shopper staples navigating inflationary pressures, the stories supply a vital snapshot of the present financial panorama and supply invaluable insights into future market traits. Analyzing these outcomes requires cautious consideration of a number of elements, together with income progress, revenue margins, steerage for the subsequent quarter, and administration commentary. This text will delve into a few of the key gamers reporting this week, highlighting the market’s expectations and potential market-moving implications of their bulletins.

The Tech Titans: Navigating a Shifting Tide

The know-how sector, a perennial driver of market efficiency, can be carefully scrutinized this week. A number of main gamers are scheduled to launch their earnings, and their efficiency can be a key indicator of the sector’s general well being. [Insert Name of Tech Company 1], a frontrunner in [Specify Industry Segment, e.g., cloud computing], is predicted to report [Expected Revenue Growth Percentage]% income progress, barely under analysts’ consensus estimates. Buyers can be notably within the firm’s steerage for the approaching quarter, as considerations stay about slowing demand for [Specify Product/Service, e.g., cloud infrastructure services] within the face of macroeconomic uncertainty. A miss on expectations might set off a sell-off, whereas a beat and powerful steerage might propel the inventory increased.

[Insert Name of Tech Company 2], a outstanding participant within the [Specify Industry Segment, e.g., social media] area, faces a distinct set of challenges. The corporate is grappling with [Specify Challenge, e.g., increased competition and advertising market slowdown], which might impression its income progress and profitability. Buyers can be eager to evaluate the corporate’s methods for navigating these headwinds and its capacity to take care of consumer engagement. A disappointing report might result in vital downward strain on the inventory worth, whereas a optimistic shock might supply a much-needed enhance.

Past these main gamers, a number of different tech corporations of various sizes and market capitalizations will report this week. These stories will present a extra granular image of the tech sector’s efficiency and spotlight any rising traits or challenges. For instance, [Insert Name of Smaller Tech Company], an organization specializing in [Specify Niche], might see vital investor curiosity if it stories robust progress in a particular market section. The efficiency of those smaller corporations can typically be a number one indicator of broader business traits.

Shopper Staples: Balancing Act Between Inflation and Demand

The buyer staples sector, historically seen as a protected haven throughout financial downturns, is going through its personal set of challenges. Inflation continues to impression shopper spending, forcing corporations to fastidiously handle their pricing methods to take care of profitability whereas avoiding alienating price-sensitive clients. [Insert Name of Consumer Staples Company 1], a serious participant within the [Specify Industry Segment, e.g., food and beverage] business, is predicted to report [Expected Revenue Growth Percentage]% income progress. Buyers can be paying shut consideration to the corporate’s pricing energy and its capacity to go on elevated prices to shoppers with out considerably impacting gross sales quantity. A robust report demonstrating resilience within the face of inflationary pressures might bolster investor confidence.

[Insert Name of Consumer Staples Company 2], a number one producer of [Specify Product Category, e.g., household goods], faces an analogous problem. The corporate’s capacity to handle its provide chain successfully and keep its market share can be essential elements influencing investor sentiment. Buyers can be searching for proof that the corporate is efficiently navigating provide chain disruptions and sustaining its profitability margins. A decline in revenue margins might set off a destructive response from the market.

Vitality Sector: Navigating Volatility and Geopolitical Uncertainty

The power sector stays a focus for buyers, notably given the continuing geopolitical uncertainty and volatility in world power markets. [Insert Name of Energy Company 1], a serious oil and fuel producer, is predicted to report [Expected Revenue Growth Percentage]% income progress, pushed by [Specify Driver, e.g., higher oil prices]. Nevertheless, buyers may even be scrutinizing the corporate’s manufacturing ranges, its capital expenditure plans, and its outlook for future power costs. Surprising adjustments in manufacturing or a shift within the firm’s outlook might considerably impression the inventory worth.

[Insert Name of Energy Company 2], a renewable power firm, may even be reporting this week. Buyers can be within the firm’s progress in increasing its renewable power capability, its securing of recent contracts, and its general monetary efficiency. The efficiency of renewable power corporations typically displays investor sentiment in direction of the broader transition to cleaner power sources.

Past the Headlines: Analyzing the Greater Image

Whereas particular person firm efficiency is essential, it is important to investigate this week’s earnings stories inside the broader context of the present financial surroundings. Elements reminiscent of inflation, rates of interest, shopper confidence, and geopolitical occasions will all play a big function in shaping market reactions to the reported outcomes. Buyers ought to contemplate the general macroeconomic image when deciphering the person firm outcomes and keep away from drawing overly simplistic conclusions primarily based solely on a single knowledge level.

Moreover, it is essential to check the reported outcomes in opposition to the corporate’s personal historic efficiency and the efficiency of its rivals. This comparative evaluation supplies a extra nuanced understanding of the corporate’s strengths and weaknesses and its place inside the broader market. Buyers also needs to pay shut consideration to administration commentary throughout earnings calls, as this typically supplies invaluable insights into the corporate’s strategic route and outlook for the longer term.

Conclusion: A Week of Important Insights

This week’s earnings calendar presents a wealth of knowledge for buyers looking for to know the present state of the financial system and the longer term trajectory of varied market sectors. By fastidiously analyzing the reported outcomes, evaluating them to expectations, and contemplating the broader macroeconomic context, buyers could make extra knowledgeable choices and navigate the complexities of the market. Do not forget that previous efficiency is just not indicative of future outcomes, and particular person firm efficiency will be influenced by a mess of things. Due to this fact, a diversified funding technique and a radical understanding of the businesses you put money into stay essential for long-term success. Keep knowledgeable, analyze critically, and make well-reasoned funding choices.

Closure

Thus, we hope this text has offered invaluable insights into This Week’s Earnings Calendar: Navigating a Sea of Information and Unpacking the Market’s Expectations. We thanks for taking the time to learn this text. See you in our subsequent article!