Navigating the 2025 Tax Submitting Deadline Calendar: A Complete Information

Associated Articles: Navigating the 2025 Tax Submitting Deadline Calendar: A Complete Information

Introduction

With enthusiasm, let’s navigate by way of the intriguing matter associated to Navigating the 2025 Tax Submitting Deadline Calendar: A Complete Information. Let’s weave fascinating data and supply recent views to the readers.

Desk of Content material

Navigating the 2025 Tax Submitting Deadline Calendar: A Complete Information

The yr 2025 is quick approaching, and with it comes the inevitable process of submitting taxes. Understanding the intricacies of tax deadlines is essential for avoiding penalties and guaranteeing a clean submitting course of. This complete information offers an in depth take a look at the 2025 tax submitting deadline calendar, masking varied tax kinds, extensions, and concerns for various conditions. Whereas particular dates are topic to alter primarily based on legislative actions, this text offers a projected calendar primarily based on present legal guidelines and historic developments.

Necessary Disclaimer: This text is for informational functions solely and doesn’t represent tax recommendation. Seek the advice of with a professional tax skilled for customized steerage relating to your particular tax state of affairs. The data offered right here is predicated on present understanding of tax legal guidelines and should change. At all times consult with official IRS publications and bulletins for essentially the most up-to-date data.

Understanding the Fundamental Tax Submitting Deadline:

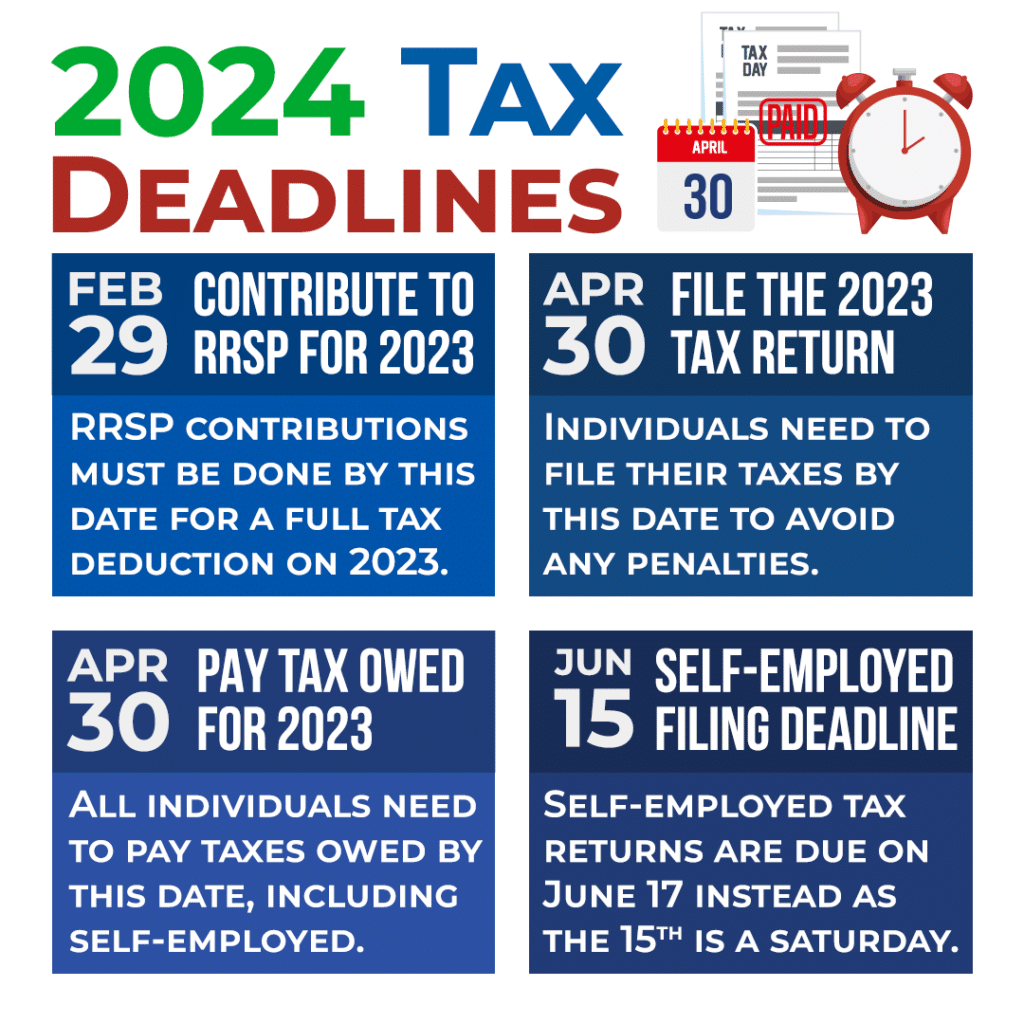

The first tax submitting deadline for most people in the USA is usually April fifteenth. Nevertheless, this date can shift if April fifteenth falls on a weekend or a vacation. In such circumstances, the deadline is prolonged to the following enterprise day. For 2025, we might want to test the calendar to find out if April fifteenth is a weekend or vacation. Whether it is, the deadline shall be adjusted accordingly. Let’s assume, for the needs of this text, that the deadline stays April fifteenth, 2025.

Projected 2025 Tax Submitting Deadline Calendar (Topic to Change):

This calendar outlines key dates and deadlines for varied tax-related actions in 2025. Bear in mind, these are projections and official dates shall be introduced by the IRS nearer to the time.

| Date | Occasion | Particulars |

|---|---|---|

| January 1st, 2025 | Tax Yr Begins | The brand new tax yr commences. |

| January thirty first, 2025 | Estimated Tax Funds (Q1) for Self-Employed | Self-employed people and others with estimated tax obligations should make their first quarterly cost. |

| April fifteenth, 2025 | Particular person Revenue Tax Submitting Deadline | Deadline for submitting particular person revenue tax returns (Kind 1040) and paying any taxes owed. |

| April fifteenth, 2025 | Estimated Tax Funds (Q2) for Self-Employed | Second quarterly estimated tax cost for self-employed people. |

| June fifteenth, 2025 | Estimated Tax Funds (Q3) for Self-Employed | Third quarterly estimated tax cost for self-employed people. |

| September fifteenth, 2025 | Estimated Tax Funds (This fall) for Self-Employed | Fourth quarterly estimated tax cost for self-employed people. |

| October fifteenth, 2025 | Deadline for requesting an computerized extension | People needing extra time to file can request an computerized six-month extension to October fifteenth. Observe: This solely extends the submitting deadline, not the cost deadline. |

| January fifteenth, 2026 | Deadline for Paying Taxes Owed (after extension) | If an extension was granted, taxes owed have to be paid by this date. |

Extensions:

The IRS permits for an computerized six-month extension to file your tax return. Nevertheless, it’s essential to know that this extension solely applies to submitting, to not paying your taxes. You continue to have to estimate your tax legal responsibility and pay by the unique April fifteenth deadline to keep away from penalties. Requesting an extension is comparatively simple, and normally will be performed electronically by way of the IRS web site.

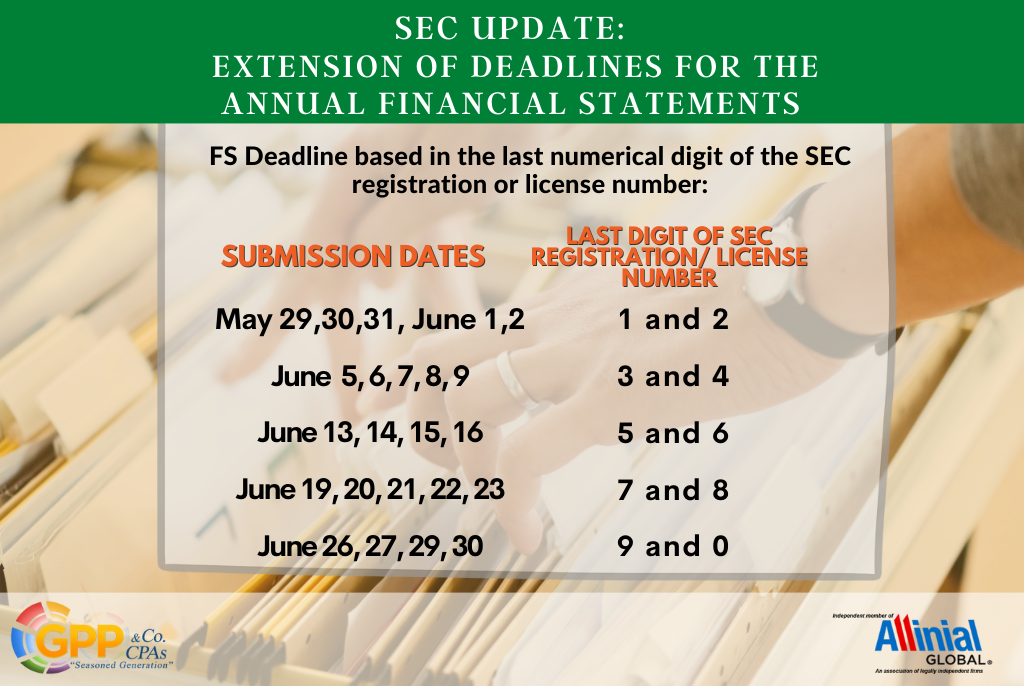

Particular Tax Kinds and Deadlines:

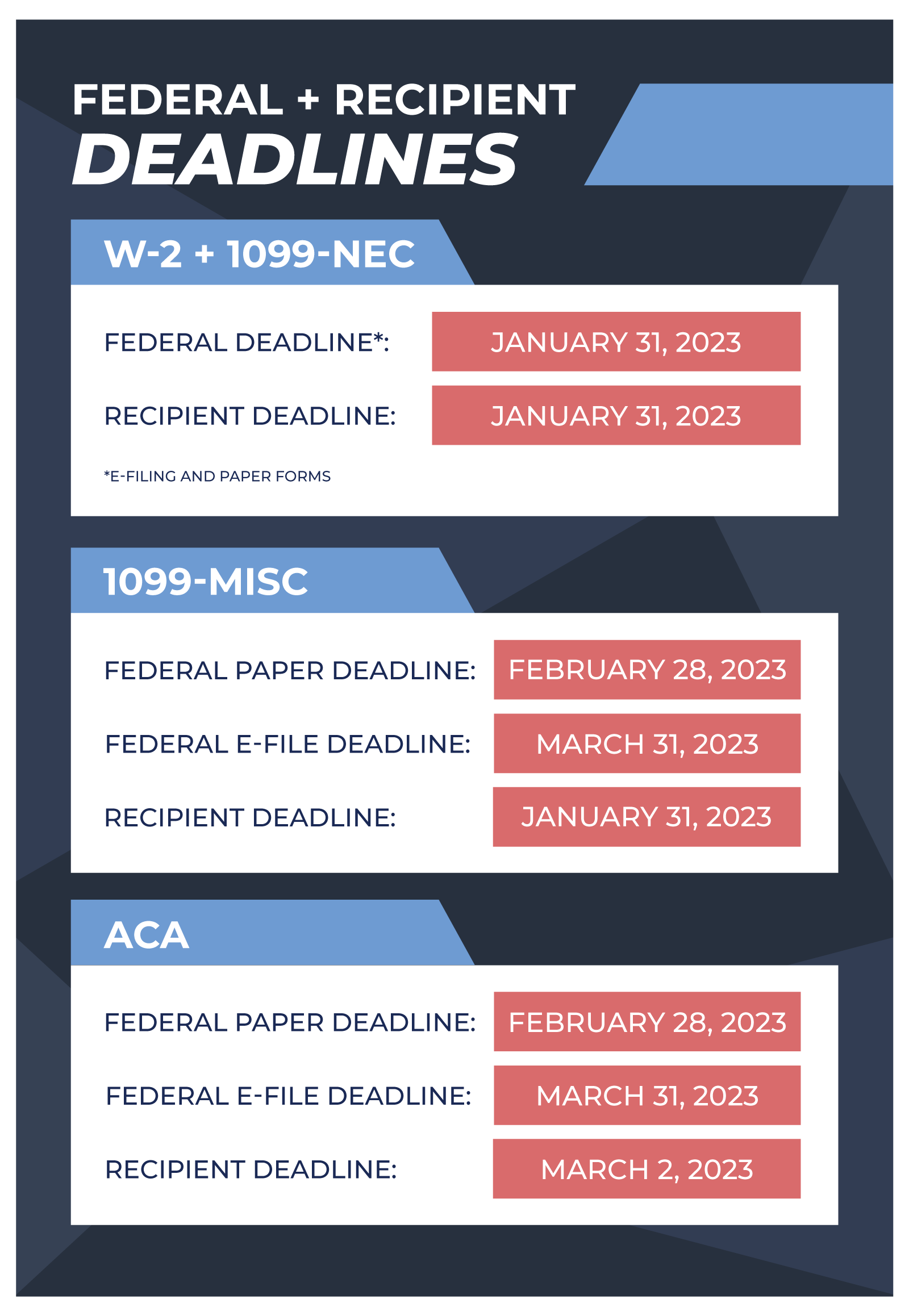

Whereas the April fifteenth deadline applies to most particular person taxpayers, some kinds have totally different deadlines or require particular actions. For instance:

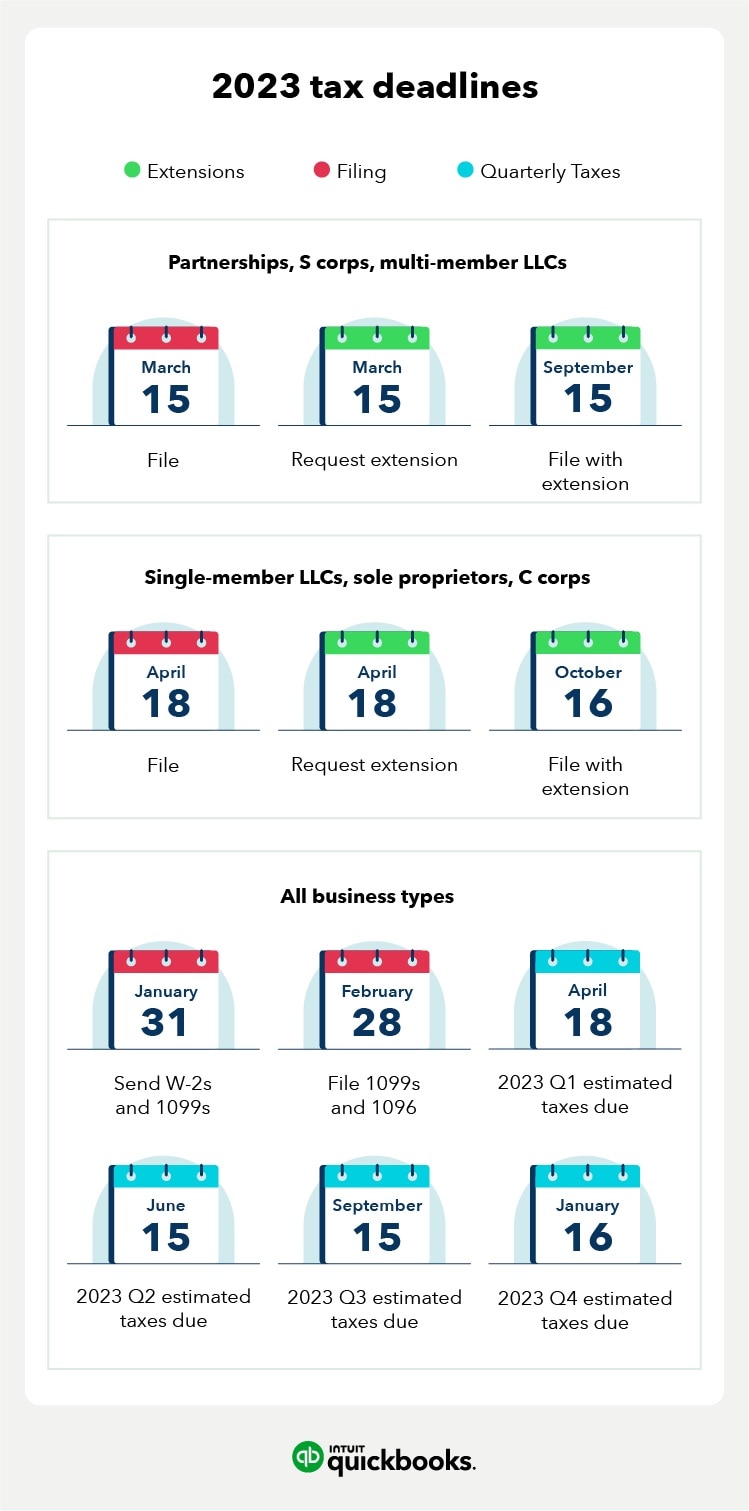

- Kind 1040-ES (Estimated Tax for People): As proven above, quarterly funds are due on particular dates all year long.

- Kind 941 (Employer’s Quarterly Federal Tax Return): This manner has quarterly deadlines for employers to report and pay payroll taxes.

- Kind 1041 (U.S. Revenue Tax Return for Estates and Trusts): This manner has a distinct deadline than particular person returns.

- Kind 1065 (U.S. Return of Partnership Revenue): Partnerships have particular deadlines for submitting their returns.

- Kind 1120 (U.S. Company Revenue Tax Return): Companies have totally different submitting deadlines than people.

These are only a few examples; the particular deadlines fluctuate relying on the tax type and the filer’s circumstances. At all times consult with the IRS directions for the particular type in query for correct and up-to-date data.

Penalties for Late Submitting and Late Fee:

Failing to file or pay your taxes by the deadline can lead to vital penalties. These penalties can embody curiosity expenses on unpaid taxes, in addition to penalties for late submitting. The quantity of the penalty can fluctuate relying on the size of the delay and the quantity owed. It is at all times finest to file on time and pay what you owe to keep away from these penalties.

Tax Planning for 2025:

Efficient tax planning is important to attenuate your tax legal responsibility and guarantee compliance. Key concerns embody:

- Maximizing Deductions and Credit: Perceive the varied deductions and credit accessible to you and guarantee you’re claiming all that you’re eligible for.

- Retirement Planning: Contribute to retirement accounts to cut back your taxable revenue.

- Funding Methods: Seek the advice of with a monetary advisor to develop an funding technique that minimizes your tax burden.

- Property Planning: If in case you have vital belongings, think about property planning methods to attenuate property taxes.

Staying Organized:

Sustaining meticulous monetary information is vital for correct tax submitting. Hold observe of all revenue, bills, and related documentation all year long. This can simplify the submitting course of and scale back the chance of errors. Think about using tax software program or partaking a tax skilled to help together with your tax preparation.

Using IRS Sources:

The IRS provides a wealth of assets to assist taxpayers perceive their obligations and navigate the submitting course of. Their web site (irs.gov) offers entry to publications, kinds, and different useful data. In addition they supply varied help applications for taxpayers who need assistance.

Conclusion:

The 2025 tax submitting deadline calendar presents a fancy panorama of dates and deadlines. Understanding these deadlines and taking proactive steps to arrange are essential for avoiding penalties and guaranteeing a clean tax submitting expertise. By staying organized, using accessible assets, and looking for skilled help when wanted, taxpayers can confidently navigate the tax season and meet their obligations. Bear in mind to seek the advice of with a professional tax skilled for customized recommendation tailor-made to your particular circumstances. This text serves as a basic information and shouldn’t be substituted for skilled tax recommendation. At all times consult with official IRS publications for essentially the most correct and up-to-date data.

Closure

Thus, we hope this text has offered helpful insights into Navigating the 2025 Tax Submitting Deadline Calendar: A Complete Information. We recognize your consideration to our article. See you in our subsequent article!