fiscal yr vs calendar yr tax

Associated Articles: fiscal yr vs calendar yr tax

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to fiscal yr vs calendar yr tax. Let’s weave fascinating info and supply contemporary views to the readers.

Desk of Content material

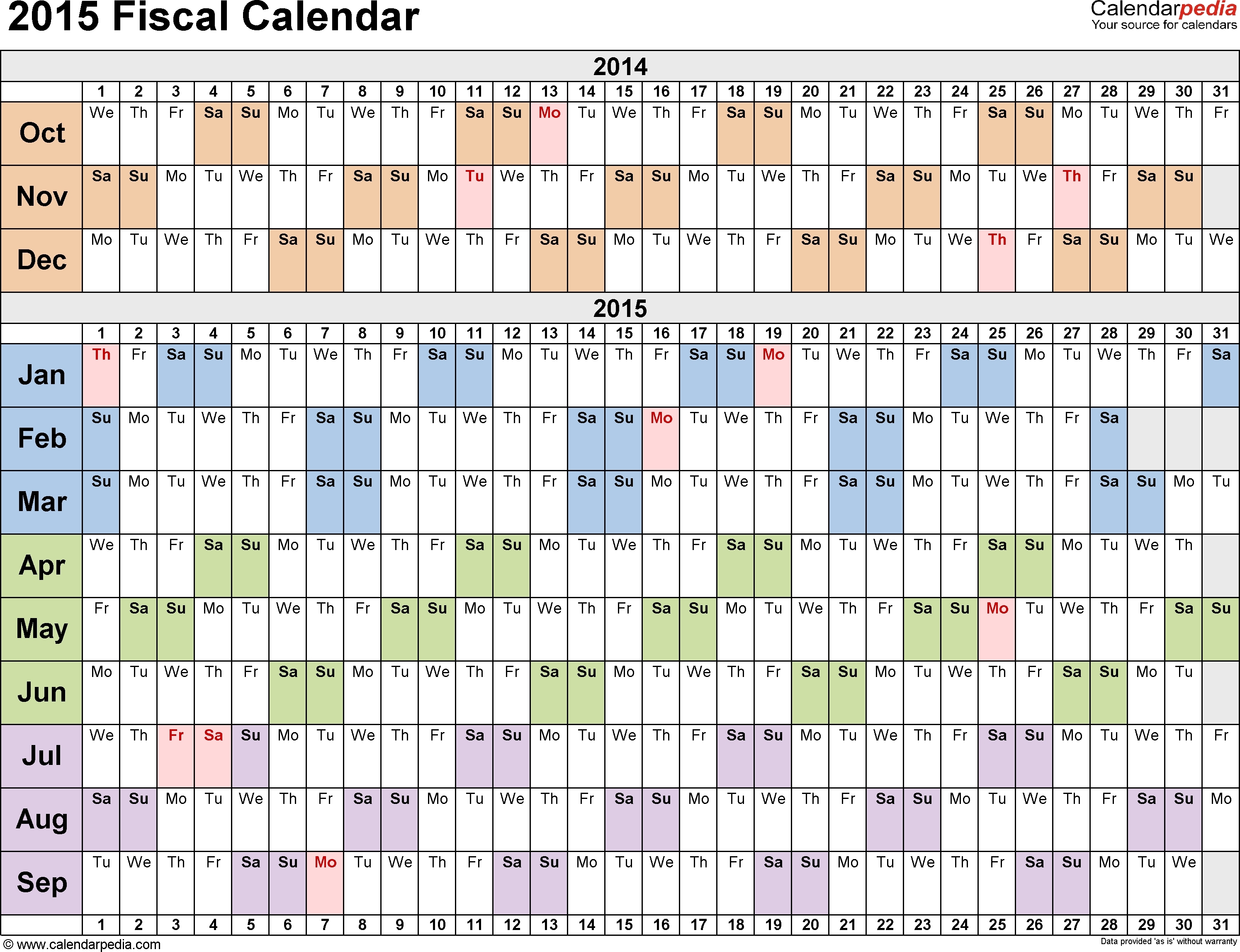

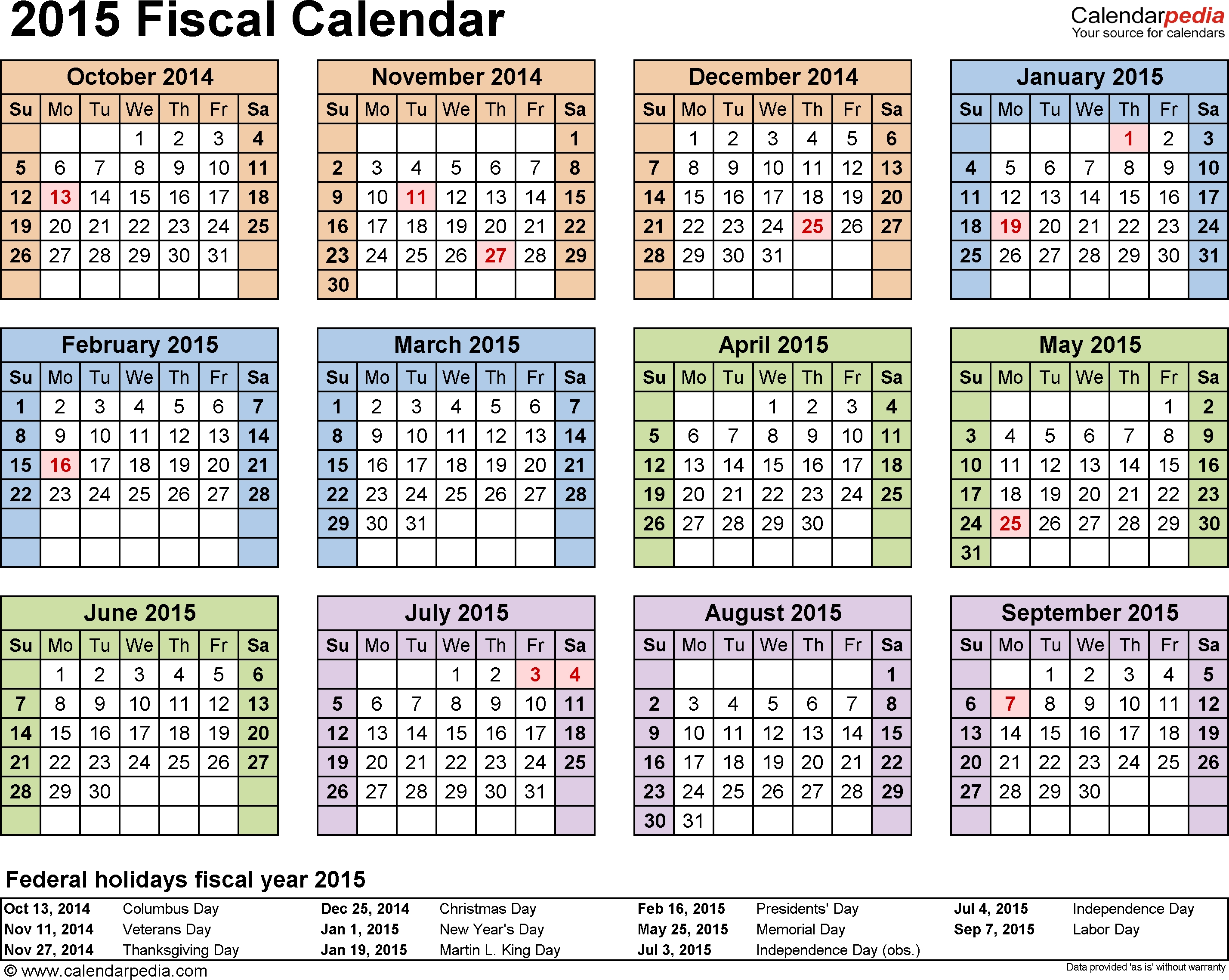

Fiscal 12 months vs. Calendar 12 months: Understanding the Variations in Tax Reporting

For most people, tax season aligns neatly with the calendar yr. January 1st to December thirty first: revenue earned, bills incurred, and taxes owed all fall inside this acquainted timeframe. Nonetheless, a good portion of companies function on a distinct schedule, using a fiscal yr as an alternative of a calendar yr. This distinction in accounting durations considerably impacts how these entities report their revenue and pay their taxes. Understanding the nuances of fiscal yr versus calendar yr taxation is essential for each companies and people interacting with them.

Calendar 12 months Outlined:

The calendar yr, as its identify suggests, follows the Gregorian calendar. It runs from January 1st to December thirty first. That is the usual tax yr for most people and a few smaller companies. The simplicity and widespread adoption of the calendar yr make it handy for each taxpayers and tax authorities. Tax returns are filed primarily based on revenue earned and bills incurred inside this 12-month interval.

Fiscal 12 months Outlined:

A fiscal yr (FY) is a 12-month interval utilized by companies and different organizations for accounting and tax functions. Not like the calendar yr, a fiscal yr does not essentially start on January 1st. It may possibly start on any date, so long as it stays constant yr after yr. Frequent fiscal yr begin dates embody July 1st, August 1st, and September 1st. The selection of a fiscal yr begin date typically aligns with a enterprise’s pure working cycle. For instance, a retail enterprise may select a fiscal yr that ends after the vacation purchasing season, offering a clearer image of annual efficiency.

Why Select a Fiscal 12 months?

The choice to undertake a fiscal yr is a strategic one, typically pushed by a number of components:

-

Enterprise Cycle Alignment: Companies with seasonal fluctuations in gross sales or operations typically discover a fiscal yr extra helpful. Ending the fiscal yr after a peak gross sales interval permits for a extra correct reflection of annual efficiency and simplifies year-end closing procedures. An organization promoting snow skis, for example, may select a fiscal yr ending in spring, after the height winter gross sales season.

-

Stock Administration: Companies with important stock might discover it simpler to handle stock counts and valuations on the finish of their fiscal yr, reasonably than on the finish of the calendar yr.

-

Business Requirements: Sure industries may need established norms for fiscal yr reporting. This could facilitate comparisons with opponents and improve trade benchmarking.

-

Tax Planning: Whereas not the first motive, a well-chosen fiscal yr can generally supply strategic tax benefits, though this requires cautious planning and consideration of varied tax implications.

Tax Implications of Utilizing a Fiscal 12 months:

The shift from a calendar yr to a fiscal yr introduces complexities in tax reporting:

-

Submitting Deadlines: Companies utilizing a fiscal yr have a distinct tax submitting deadline than these utilizing a calendar yr. Their tax returns are due a number of months after the top of their fiscal yr, providing them extra time for preparation. Nonetheless, this prolonged timeframe requires meticulous planning to make sure well timed submitting and cost of taxes.

-

Estimated Tax Funds: Companies working on a fiscal yr should make estimated tax funds all year long to keep away from penalties. These funds are usually made quarterly, primarily based on the projected tax legal responsibility for the fiscal yr. Correct estimation is essential to keep away from underpayment penalties.

-

Accounting Complexity: Sustaining separate fiscal yr accounting data requires extra refined accounting programs and experience. This provides to administrative prices and necessitates a better stage of monetary administration.

-

Reconciliation Challenges: Reconciling fiscal yr knowledge with calendar yr knowledge will be difficult, particularly when coping with intercompany transactions or consolidated monetary statements. This requires cautious coordination and meticulous record-keeping.

Tax Varieties and Reporting:

The tax kinds used for fiscal yr reporting are usually the identical as these used for calendar yr reporting, however the reporting interval displays the fiscal yr. For instance, a company utilizing a fiscal yr ending June thirtieth would file Type 1120 for the interval July 1st to June thirtieth. The directions for these kinds will clearly point out the best way to report revenue and bills for a fiscal yr.

People and Fiscal 12 months Companies:

People who’re workers of a fiscal yr enterprise will nonetheless file their private revenue tax returns on a calendar yr foundation. Their W-2 kinds will replicate their earnings for the calendar yr, no matter their employer’s fiscal yr. Nonetheless, understanding the employer’s fiscal yr will be useful in understanding when bonuses or different funds is likely to be acquired.

Selecting the Proper Tax 12 months:

The choice to undertake a calendar yr or a fiscal yr is a major one. Companies ought to rigorously weigh the benefits and drawbacks primarily based on their particular circumstances. Consulting with a tax skilled is extremely really helpful to find out the optimum tax yr for a given enterprise, contemplating components like trade norms, operational cycles, and tax implications. A well-chosen tax yr can streamline accounting processes, enhance monetary reporting accuracy, and in the end contribute to raised monetary administration.

Potential Disadvantages of a Fiscal 12 months:

Whereas fiscal years supply benefits, additionally they current potential drawbacks:

-

Elevated Complexity: Sustaining separate monetary data for a fiscal yr provides complexity to accounting and reporting processes. This could improve administrative prices and require specialised accounting software program or experience.

-

Delayed Reporting: The delayed submitting deadline, whereas providing extra time for preparation, may result in an extended interval of uncertainty relating to tax legal responsibility.

-

Coordination Challenges: Reconciling fiscal yr knowledge with calendar yr knowledge, particularly when coping with a number of entities or consolidated monetary studies, will be advanced and time-consuming.

-

Potential for Confusion: Utilizing a fiscal yr can result in confusion for workers, buyers, and different stakeholders accustomed to calendar yr reporting. Clear communication and clear reporting are essential to mitigate this threat.

In Conclusion:

The selection between a calendar yr and a fiscal yr is an important determination for companies, impacting their accounting, tax reporting, and total monetary administration. Whereas the calendar yr gives simplicity and widespread adoption, the fiscal yr can supply important strategic benefits for companies with particular operational wants. Understanding the implications of every and selecting the suitable reporting interval requires cautious consideration of varied components {and professional} steering. Finally, the most effective tax yr is the one which greatest aligns with the enterprise’s distinctive traits and targets, making certain correct monetary reporting and environment friendly tax compliance.

Closure

Thus, we hope this text has offered invaluable insights into fiscal yr vs calendar yr tax. We thanks for taking the time to learn this text. See you in our subsequent article!