fiscal calendar vs common calendar

Associated Articles: fiscal calendar vs common calendar

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to fiscal calendar vs common calendar. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Fiscal Calendar vs. Common Calendar: Understanding the Variations and Their Impression

The Gregorian calendar, the globally acknowledged system for monitoring time, governs our each day lives. We schedule appointments, plan holidays, and have a good time holidays in keeping with its construction of months and years. Nonetheless, for a lot of companies and authorities entities, this is not the one calendar that issues. The fiscal calendar, a definite accounting interval, usually runs parallel to, and generally diverges considerably from, the common calendar. Understanding the variations between these two methods is essential for anybody concerned in finance, accounting, or enterprise administration.

This text delves into the intricacies of fiscal and common calendars, exploring their distinct traits, the explanations for his or her divergence, and the implications of utilizing one over the opposite. We are going to look at the advantages and disadvantages of every system, highlighting situations the place one is likely to be most well-liked over the opposite.

The Common Calendar: A Basis of Timekeeping

The Gregorian calendar, our normal timekeeping system, is a photo voltaic calendar with twelve months, totaling twelve months in a yr, with an additional day added in leap years. Its construction is comparatively constant, offering a well-known framework for organizing private and societal actions. Its uniformity simplifies scheduling, planning, and comparability of knowledge throughout completely different durations. This predictability is crucial for private and social group, facilitating the coordination of occasions and the monitoring of progress over time.

The common calendar’s simplicity is its power. Its widespread adoption ensures frequent understanding and facilitates communication throughout numerous contexts. Nonetheless, its mounted construction does not at all times align completely with the operational cycles of companies or the budgetary wants of governments.

The Fiscal Calendar: A Enterprise-Oriented Method to Time

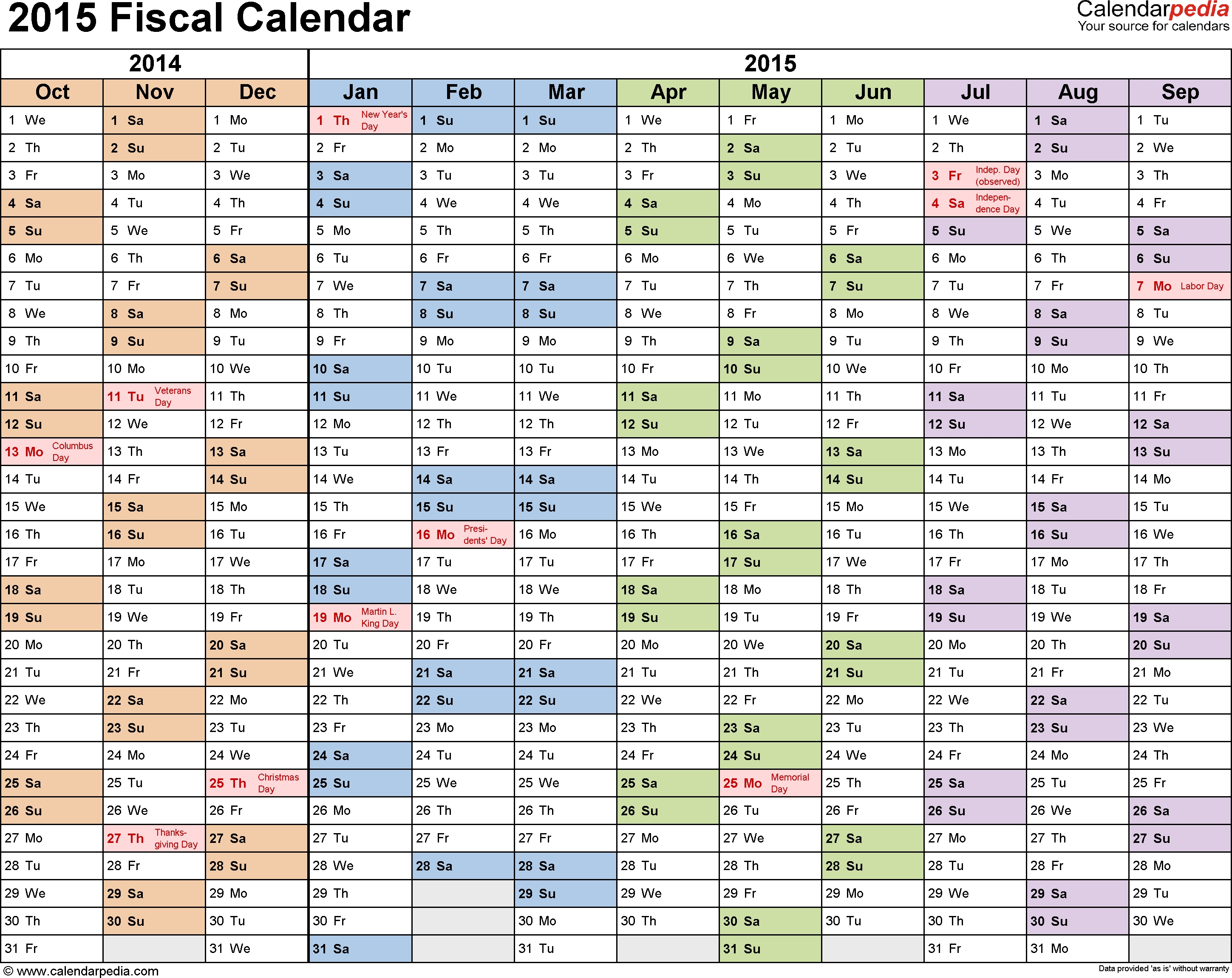

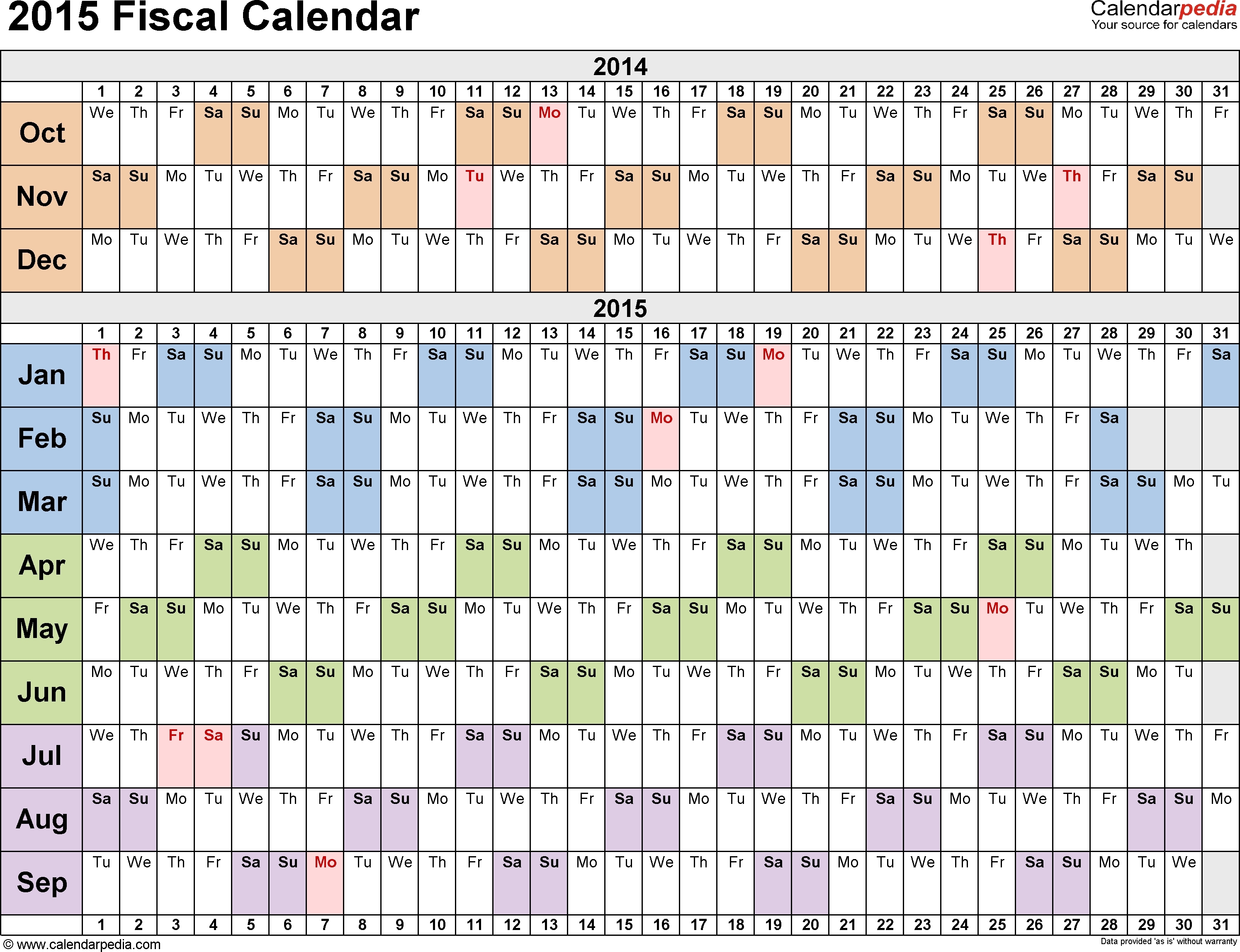

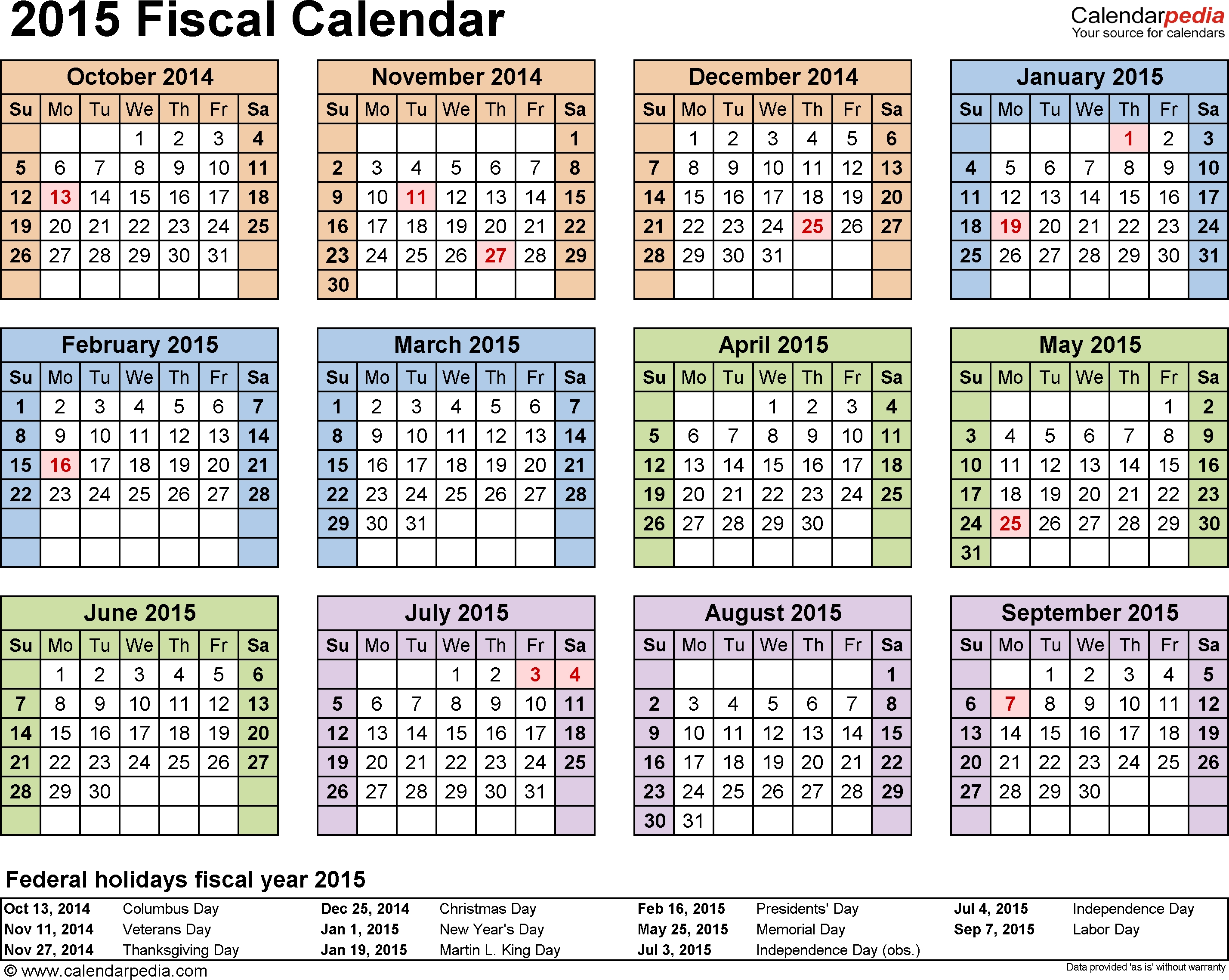

The fiscal calendar, however, is a particular accounting interval utilized by organizations for monetary reporting and planning. Not like the common calendar, which is mounted, the fiscal calendar can differ considerably relying on the group’s wants and {industry} practices. It usually covers a 12-month interval, however its beginning and ending dates can differ from these of the common calendar.

Widespread fiscal yr begin dates embrace:

- January 1st: This aligns with the common calendar and simplifies bookkeeping for some organizations.

- July 1st: It is a standard alternative, significantly in some academic establishments and authorities companies.

- April 1st: That is one other frequent begin date, particularly for companies in sure industries.

- Different Dates: Some organizations might select a fiscal yr that aligns with their particular operational cycles or different business-related components.

The selection of a fiscal yr begin date is strategic. Organizations usually choose a date that coincides with the tip of a serious operational cycle, corresponding to the tip of a manufacturing run, the completion of a serious undertaking, or the shut of a peak gross sales season. This enables for a extra correct reflection of the group’s monetary efficiency inside a particular operational context.

Why the Divergence? Causes for Selecting a Fiscal Calendar

The divergence between the fiscal and common calendars stems from the necessity for companies and governments to align their monetary reporting with their operational cycles. A number of key causes contribute to this divergence:

-

Enterprise Cycles: Many companies expertise seasonal fluctuations in gross sales, manufacturing, and bills. A fiscal yr that aligns with these cycles permits for a extra correct evaluation of efficiency and facilitates higher budgeting and forecasting. For instance, a retail firm would possibly select a fiscal yr that ends after the vacation purchasing season to seize the total affect of its peak gross sales interval.

-

Taxation and Reporting: Fiscal years usually align with tax reporting deadlines, streamlining the method and simplifying compliance. This ensures that monetary statements precisely replicate the tax yr, facilitating smoother tax filings and audits.

-

Budgeting and Planning: A well-defined fiscal yr permits for efficient budgeting and planning. Organizations can allocate assets, set targets, and monitor progress towards pre-defined monetary objectives inside a clearly outlined timeframe.

-

Trade Practices: Sure industries have established conventions concerning fiscal yr begin dates. Adhering to those practices facilitates comparisons between opponents and promotes industry-wide standardization.

-

Inside Management and Administration: A separate fiscal calendar helps in inside management and higher administration of the group’s assets and funds. It permits for a extra centered overview of the group’s monetary well being throughout a particular interval.

Implications of Utilizing Completely different Calendars

The usage of separate fiscal and common calendars presents each benefits and challenges:

Benefits:

- Improved Monetary Reporting: Aligning the fiscal yr with operational cycles results in extra correct and significant monetary statements.

- Efficient Budgeting and Forecasting: A clearly outlined fiscal yr simplifies budgeting and forecasting processes.

- Enhanced Inside Management: Separating monetary reporting from the common calendar improves inside management mechanisms.

- Higher Useful resource Allocation: Organizations can higher allocate assets primarily based on their operational cycles and monetary efficiency inside the fiscal yr.

Challenges:

- Elevated Complexity: Managing two separate calendar methods might be extra advanced than utilizing solely the common calendar.

- Coordination Points: Coordinating actions and reporting throughout each calendars requires cautious planning and communication.

- Information Reconciliation: Reconciling knowledge from the fiscal calendar with knowledge from the common calendar might be time-consuming.

- Potential for Confusion: The usage of two separate calendars can result in confusion if not managed correctly.

Examples of Fiscal Calendar Utilization

The usage of fiscal calendars is widespread throughout numerous sectors:

- Authorities Companies: Many authorities companies function on fiscal years that differ from the common calendar, usually aligning with budgetary cycles and tax reporting necessities.

- Academic Establishments: Faculties and universities generally use fiscal years that align with their tutorial calendars, usually beginning in July or August.

- Companies: Massive companies usually undertake fiscal years that align with their operational cycles and peak gross sales durations.

- Non-profit Organizations: Non-profits might use fiscal years that align with their grant cycles or fundraising actions.

Conclusion:

The fiscal calendar, whereas seemingly a minor variation on the common calendar, performs a major function within the monetary administration of organizations. Its divergence from the common calendar is a strategic alternative pushed by the necessity to align monetary reporting with operational cycles, optimize useful resource allocation, and improve the accuracy of monetary reporting. Understanding the variations and implications of utilizing each calendars is essential for anybody concerned in finance, accounting, or enterprise administration. Whereas the added complexity of managing two calendars requires cautious planning and coordination, the advantages by way of improved monetary reporting, budgeting, and total organizational effectivity usually outweigh the challenges. The selection of a fiscal calendar is a strategic resolution that needs to be tailor-made to the particular wants and operational context of every group.

![]()

Closure

Thus, we hope this text has offered beneficial insights into fiscal calendar vs common calendar. We thanks for taking the time to learn this text. See you in our subsequent article!