distinction between fiscal and calendar 12 months

Associated Articles: distinction between fiscal and calendar 12 months

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to distinction between fiscal and calendar 12 months. Let’s weave fascinating data and provide contemporary views to the readers.

Desk of Content material

Fiscal Yr vs. Calendar Yr: Understanding the Variations and Implications

The phrases "fiscal 12 months" and "calendar 12 months" are steadily used, notably in enterprise and authorities contexts, however their distinct meanings are sometimes blurred. Understanding the distinction between these two accounting intervals is essential for anybody concerned in monetary planning, budgeting, and evaluation. This text delves into the nuances of fiscal and calendar years, exploring their definitions, variations, causes for his or her use, and the implications of selecting one over the opposite.

Defining the Phrases:

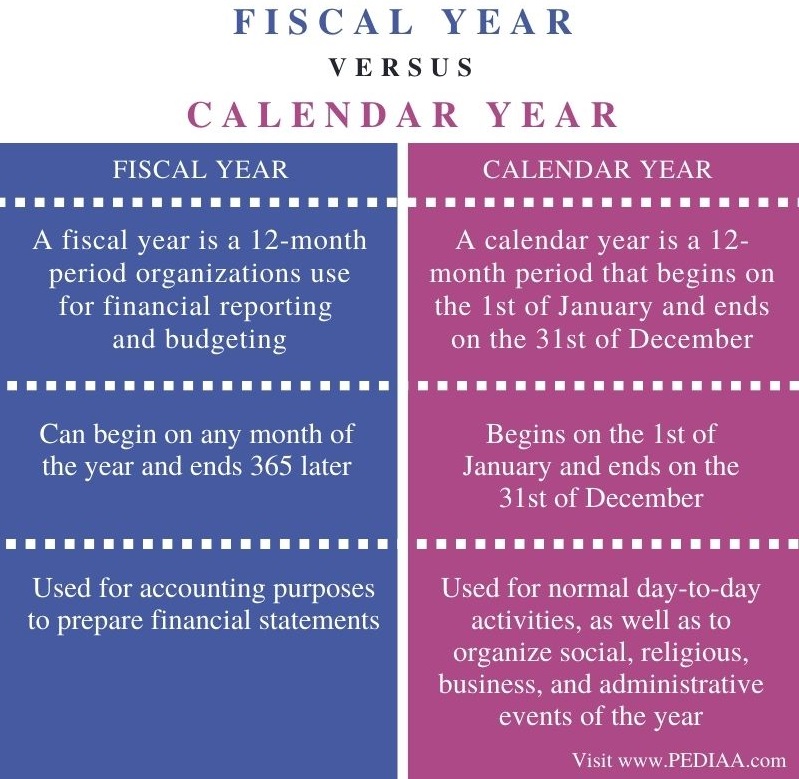

The calendar 12 months is a universally acknowledged interval encompassing twelve months (or 366 in a bissextile year), beginning on January 1st and ending on December thirty first. It is a simple and constant timeframe used for a lot of on a regular basis functions, together with private record-keeping, tax filings (in lots of international locations), and normal time administration. Its simplicity and international standardization make it a handy benchmark for comparability.

The fiscal 12 months (FY), however, is a 12-month accounting interval {that a} enterprise or authorities makes use of for monetary reporting functions. In contrast to the calendar 12 months, the fiscal 12 months’s begin and finish dates aren’t mounted and may differ relying on the group’s particular wants and business practices. A fiscal 12 months can start on any date, however it usually aligns with pure enterprise cycles or particular reporting necessities.

Why the Discrepancy? The Rationale Behind Fiscal Years:

The first motive for the existence of fiscal years totally different from the calendar 12 months is to raised mirror the operational cycles and monetary realities of a company. A number of elements contribute to this:

-

Enterprise Cycles: Many companies expertise seasonal fluctuations in gross sales, manufacturing, and bills. A fiscal 12 months aligned with these cycles permits for a extra correct reflection of efficiency. For instance, a retailer may select a fiscal 12 months that begins within the fall, encompassing the essential vacation procuring season. This enables them to precisely assess their yearly efficiency inside the context of their peak gross sales interval.

-

Trade Conventions: Sure industries have established conventions relating to fiscal 12 months begin dates. As an example, many agricultural companies might align their fiscal 12 months with the planting and harvesting seasons. This supplies a clearer image of profitability and useful resource allocation all year long.

-

Reporting Necessities: Governmental rules and accounting requirements usually dictate particular reporting intervals. Firms may have to regulate their fiscal 12 months to adjust to these necessities, notably when coping with worldwide operations or particular business rules.

-

Inner Administration: An organization may select a fiscal 12 months that most closely fits its inside administration and reporting wants. This enables for simpler finances planning, efficiency analysis, and useful resource allocation primarily based on their very own particular operational movement.

-

Tax Implications: Whereas not the first driver, the selection of fiscal 12 months can have tax implications. An organization may select a fiscal 12 months that permits for extra strategic tax planning and optimization.

Frequent Fiscal Yr Begin Dates:

Whereas a fiscal 12 months can start on any date, some begin dates are extra frequent than others:

-

July 1st: It is a in style alternative, notably in the USA, permitting for the inclusion of the summer season months and offering a transparent separation from the calendar 12 months.

-

April 1st: One other frequent begin date, notably in some European international locations, aligning with the tip of the tax 12 months in some jurisdictions.

-

October 1st: This begin date is typically chosen to coincide with the start of a brand new educational 12 months or a selected business’s operational cycle.

-

January 1st: Whereas much less frequent for companies, some organizations may select to align their fiscal 12 months with the calendar 12 months for simplicity.

Key Variations Summarized:

| Function | Calendar Yr | Fiscal Yr |

|---|---|---|

| Begin Date | January 1st | Variable (July 1st, April 1st, and so on.) |

| Finish Date | December thirty first | Variable (June thirtieth, March thirty first, and so on.) |

| Function | Common timekeeping, societal conventions | Monetary reporting, inside administration |

| Size | twelve months (or 366 in a bissextile year) | twelve months (or 366 in a bissextile year) |

| Standardization | Globally standardized | Varies by group and business |

Implications of Selecting a Fiscal Yr:

The selection of a fiscal 12 months has vital implications for numerous points of a company’s operations:

-

Budgeting and Forecasting: A well-chosen fiscal 12 months permits for extra correct budgeting and forecasting, as it will possibly align with predictable income streams and expense patterns.

-

Efficiency Analysis: Evaluating efficiency throughout fiscal years supplies a constant foundation for evaluating progress and figuring out traits.

-

Monetary Reporting: The selection of fiscal 12 months impacts the timing and content material of economic studies, influencing how stakeholders understand the group’s efficiency.

-

Inner Controls: A well-defined fiscal 12 months helps in establishing strong inside controls and guaranteeing compliance with accounting requirements.

-

Tax Planning: The fiscal 12 months can affect tax planning methods, permitting companies to optimize their tax liabilities.

Challenges of Utilizing a Fiscal Yr:

Whereas fiscal years provide benefits, in addition they current challenges:

-

Complexity: Coping with a fiscal 12 months totally different from the calendar 12 months can add complexity to record-keeping, reporting, and inside processes.

-

Coordination: Coordinating with different organizations, notably these utilizing the calendar 12 months, may be difficult.

-

Comparability Difficulties: Evaluating monetary efficiency with different organizations utilizing totally different fiscal years requires cautious changes and evaluation.

Conclusion:

The selection between a fiscal 12 months and a calendar 12 months is a strategic resolution that ought to be fastidiously thought-about primarily based on a company’s distinctive circumstances. Whereas the calendar 12 months presents simplicity and standardization, the fiscal 12 months permits for a extra correct reflection of enterprise cycles and operational realities. Understanding the nuances of each accounting intervals is important for efficient monetary administration, reporting, and decision-making. Companies and governments should fastidiously weigh the benefits and downsides earlier than deciding on a fiscal 12 months that finest aligns with their particular wants and targets, guaranteeing correct monetary reporting and knowledgeable strategic planning. The final word objective is to decide on a system that gives the clearest and most correct image of the group’s monetary well being and efficiency.

Closure

Thus, we hope this text has supplied helpful insights into distinction between fiscal and calendar 12 months. We thanks for taking the time to learn this text. See you in our subsequent article!