diagonal unfold vs calendar unfold

Associated Articles: diagonal unfold vs calendar unfold

Introduction

On this auspicious event, we’re delighted to delve into the intriguing matter associated to diagonal unfold vs calendar unfold. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Diagonal Unfold vs. Calendar Unfold: A Deep Dive into Possibility Methods

Choices buying and selling provides a various vary of methods to handle threat and capitalize on market actions. Amongst these, diagonal spreads and calendar spreads stand out as fashionable decisions for knowledgeable merchants looking for outlined threat profiles and probably profitable returns. Whereas each contain a number of choices contracts with various expiration dates and strike costs, they differ considerably of their risk-reward traits and suitability for particular market outlooks. This text delves into the intricacies of each methods, evaluating and contrasting their mechanics, potential income and losses, and optimum market situations for implementation.

Understanding Diagonal Spreads

A diagonal unfold is an choices technique that mixes an extended and a brief possibility place with totally different strike costs and totally different expiration dates. This creates a extra complicated profile than a easy vertical unfold (identical expiration date) or a calendar unfold (identical strike worth). The most typical kind entails an extended name or put possibility with a later expiration date and a brief name or put possibility with an earlier expiration date. The quick possibility acts as a credit score generator, partially offsetting the price of the lengthy possibility.

Mechanics of a Diagonal Unfold:

- Lengthy Possibility: That is the choice with the longer expiration date. It gives the potential for important revenue if the underlying asset strikes favorably. The strike worth of this feature could be at-the-money (ATM), in-the-money (ITM), or out-of-the-money (OTM), relying on the dealer’s outlook.

- Quick Possibility: That is the choice with the shorter expiration date. It generates premium revenue, decreasing the general value of the technique. The strike worth of the quick possibility could be the identical as, increased than (for calls), or decrease than (for places) the lengthy possibility’s strike worth.

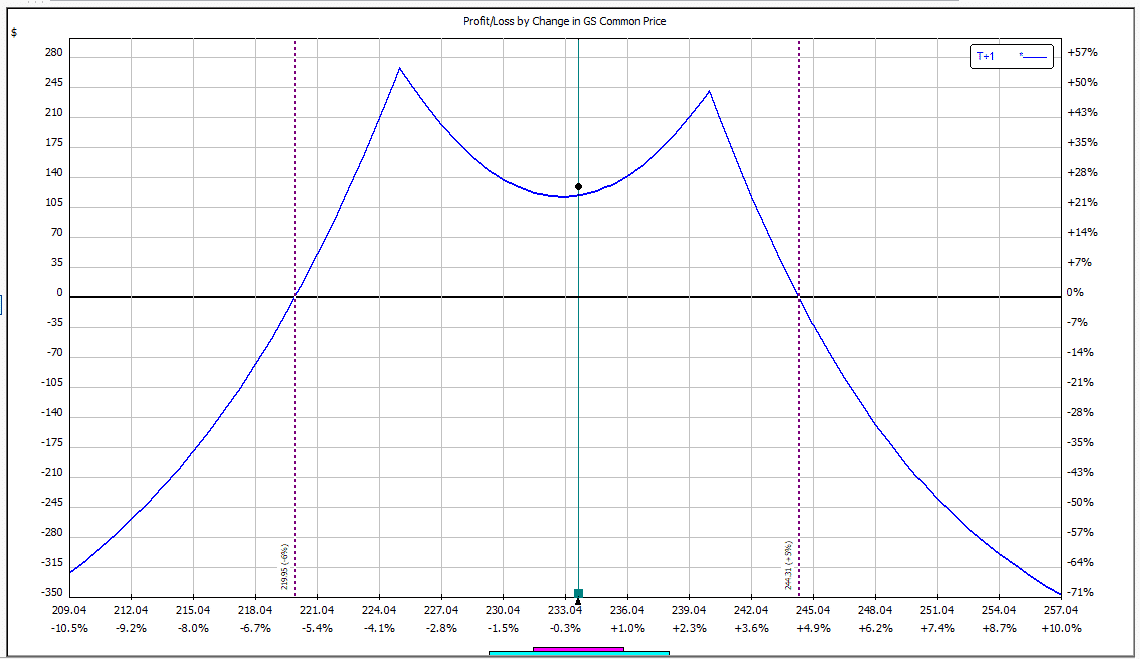

- Revenue/Loss Profile: The revenue/loss profile of a diagonal unfold is asymmetrical and sophisticated, relying on the chosen strike costs and expiration dates. Most revenue is proscribed to the online premium acquired plus the distinction between the strike costs multiplied by the variety of contracts, whereas most loss is proscribed to the preliminary internet debit paid.

Instance of a Bullish Diagonal Name Unfold:

A dealer believes that the worth of XYZ inventory will rise considerably over the subsequent few months. They may execute a bullish diagonal name unfold by:

- Shopping for one XYZ name possibility with a strike worth of $100 and an expiration date of three months from now.

- Promoting one XYZ name possibility with a strike worth of $105 and an expiration date of 1 month from now.

This technique income most if the worth of XYZ rises above $105 earlier than the one-month expiration, and continues to rise above $100 till the three-month expiration. The quick name limits revenue potential but additionally reduces the preliminary value of the commerce.

Appropriate Market Situations for Diagonal Spreads:

Diagonal spreads are greatest suited to markets anticipated to expertise a major directional transfer over an extended timeframe, however with some uncertainty in regards to the timing of that transfer. They’re much less efficient in sideways or risky markets. They’re additionally helpful when a dealer anticipates a gradual worth enhance or lower, permitting time for the commerce to develop into worthwhile.

Benefits of Diagonal Spreads:

- Outlined Danger: Most loss is capped on the preliminary internet debit paid.

- Asymmetrical Payoff: Potential for important revenue if the underlying asset strikes within the anticipated route.

- Time Decay Administration: The shorter-dated possibility decays sooner, probably producing further revenue.

- Flexibility: Varied mixtures of strike costs and expiration dates enable customization to totally different market views.

Understanding Calendar Spreads

A calendar unfold, also referred to as a time unfold, entails shopping for and promoting choices contracts on the identical underlying asset with the identical strike worth however totally different expiration dates. The dealer concurrently buys a longer-dated possibility and sells a shorter-dated possibility. This technique income primarily from the time decay (theta) of the shorter-dated possibility.

Mechanics of a Calendar Unfold:

- Lengthy Possibility: That is the choice with the longer expiration date. It gives safety towards giant unfavorable actions within the underlying asset worth.

- Quick Possibility: That is the choice with the shorter expiration date. It generates premium revenue, and its worth decays sooner than the lengthy possibility.

- Revenue/Loss Profile: The revenue/loss profile of a calendar unfold is usually outlined, and income are maximized when the underlying asset’s worth stays comparatively steady across the strike worth till the shorter-dated possibility expires nugatory. Losses happen if the underlying asset worth strikes considerably in both route earlier than the shorter-dated possibility expires.

Instance of a Lengthy Calendar Name Unfold:

A dealer is impartial on the route of XYZ inventory however believes volatility will lower. They may execute an extended calendar name unfold by:

- Shopping for one XYZ name possibility with a strike worth of $100 and an expiration date of three months from now.

- Promoting one XYZ name possibility with a strike worth of $100 and an expiration date of 1 month from now.

This technique income if the worth of XYZ stays comparatively steady round $100 till the one-month possibility expires. The quick possibility loses worth on account of time decay, producing revenue.

Appropriate Market Situations for Calendar Spreads:

Calendar spreads are best in markets anticipated to expertise low volatility or a interval of sideways worth motion. They’re much less appropriate for markets anticipating robust directional strikes or important volatility will increase. The technique depends on time decay to generate revenue, so a interval of relative worth stability is important.

Benefits of Calendar Spreads:

- Outlined Danger: Most loss is proscribed to the online debit paid.

- Revenue from Time Decay: The technique advantages from the time decay of the shorter-dated possibility.

- Impartial Market View: Appropriate for merchants with a impartial outlook on the underlying asset’s worth route.

- Decrease Capital Requirement: In comparison with another methods, calendar spreads typically require much less capital.

Diagonal Unfold vs. Calendar Unfold: A Comparability

| Function | Diagonal Unfold | Calendar Unfold |

|---|---|---|

| Strike Costs | Totally different | Similar |

| Expiration Dates | Totally different | Totally different |

| Market Outlook | Directional transfer (bullish or bearish) | Low volatility, sideways motion |

| Revenue Potential | Greater, however depending on route and timing | Decrease, however extra constant if market stays range-bound |

| Danger | Outlined, however complicated revenue/loss profile | Outlined, less complicated revenue/loss profile |

| Time Decay | Performs a job, however much less dominant than route | Main driver of revenue |

Conclusion

Each diagonal spreads and calendar spreads provide defined-risk choices methods, however they cater to totally different market expectations and dealer profiles. Diagonal spreads are appropriate for merchants anticipating a directional transfer, whereas calendar spreads are extra applicable for impartial market views and low volatility environments. Understanding the nuances of every technique, together with their revenue/loss profiles and the underlying market situations, is essential for profitable implementation. Merchants ought to fastidiously analyze market dynamics and their very own threat tolerance earlier than using both technique. Moreover, thorough backtesting and a stable understanding of choices pricing fashions are important for efficient threat administration and maximizing the potential returns of those refined buying and selling methods. Do not forget that choices buying and selling entails important threat, and losses can exceed the preliminary funding. Seek the advice of with a monetary advisor earlier than participating in choices buying and selling.

Closure

Thus, we hope this text has supplied helpful insights into diagonal unfold vs calendar unfold. We recognize your consideration to our article. See you in our subsequent article!